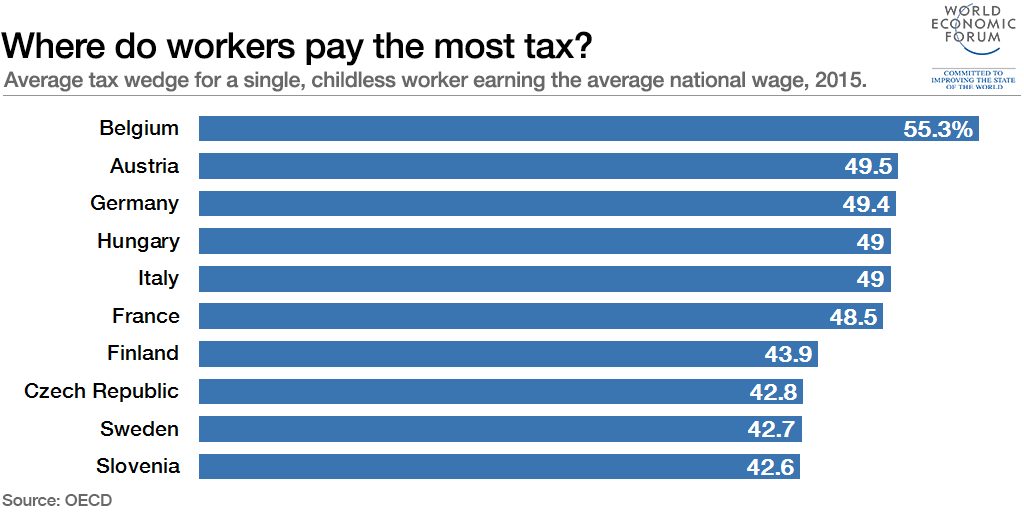

Belgians pay higher tax rates than any other citizens in OECD countries, according to the organization’s new Taxing Wages 2016 report. A childless, single worker earning the average national wage in Belgium has an average tax wedge of over 55,00 %.

The tax wedge refers to personal income tax, employer and employee social security contributions, minus family benefits received as a proportion of total employer labour costs.

Across the OECD, the tax wedge on the average worker was 35,00 % in 2015 – the same as the year before.

Where do workers pay the most tax?

Following Belgium, Austria has the second highest tax rate. The average childless, single Austrian has a tax wedge of just under 50,00 %. The top three is completed by Austria’s neighbour Germany. Here, the wedge is marginally lower at 49,40 %.

At the other end of the scale, average earners in Chile pay just 7,00 % tax.

Across different household types, a varied picture emerges. For example, for a single-earner family with two children, the tax wedge is highest in France, at 40,50 %. The overall picture is one of higher tax burdens in Europe, compared with other OECD nations. The majority of European countries sit above the OECD average of 35,90 %.

This interactive tool from the OECD allows you to explore the situation across household types and tax levels.